Video a la mode

February 13, 2016

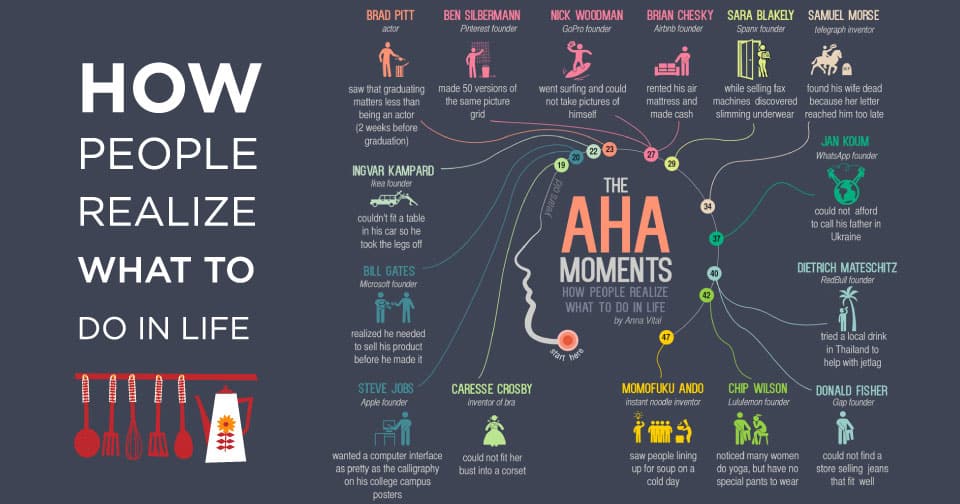

Inventors “AHA” Moments

February 13, 2016Conducting Market Research

A guide to using market research to understand who your customers are and what they want.

If you don’t know your customer, then you don’t know your business. You won’t know how to respond if you see changes in your sales patterns. And because it’s so hard to hang on to customers you don’t know intimately, you will forever be chasing new ones. Unfortunately, though most business owners like to think they know their customers, many are really only guessing.

Professional market researchers generally divide their work into qualitative studies (interviews and focus groups, with free-flowing and open-ended discussions) and quantitative studies (usually surveys). In a perfect world, you would probably do both, using qualitative research to create a survey, the results of which might in turn be interpreted using another focus group. Given limited resources, though, it generally makes sense to go quantitative.

After all “some data, is better than none.”

Building a Better Survey

1. Define Your Survey Target

First, identify the customers to survey. In general, it makes sense to focus on your best customers. “You want to look at the upper 60 percent of your customers by sales,” according to Sprague. Naturally, this is easiest for companies that track purchases and customers individually: Rank your customers by sales and lop off the bottom 40 percent. Alternatively, your sales or accounts receivable staff ought to know who your most reliable buyers are.

Retail shops and other establishments in which purchases are small and buyers tend to remain anonymous may have to settle for a smaller sample from a broader range of customers. But even these businesses can identify their best customers by encouraging customers to fill out a postage-paid postcard with very basic information or by asking them at the register for a Zip code, which can then be used to create a demographic profile. (See “Decoding Demographics.”) You might also institute a frequent-customer program, in which you offer a discount or other incentive in exchange for a small amount of personal information and an opportunity to contact the customer later. Newsletters and e-mail updates are also an opportunity to identify whom to contact later; ditto the prize drawing that requires a business card to enter.

2. Decide on a Format

There are basically three ways to administer a survey: by mail, by phone, or online. A highly personalized letter is best when the survey population is hard to reach. A phone interview serves well for complex and probing questions that demand interaction between interviewer and subject, but it normally requires professional assistance. Most businesses, though, will do very well with an online survey. Many survey companies, offer inexpensive tools and complex branched questions, in which a specific response to one query generates a specific follow-up. And they are fast, you can see results in real time.

Experts say that a written survey should take from five to 15 minutes to complete. Divide your questions between customer satisfaction and customer demographics weighted toward the former. And keep it short, says Sprague, who includes fewer than 10 questions when he writes surveys for his clients. “By limiting the number of questions, you improve the response rate,” he says. “And it forces you to think about what’s important.”

3. Probe Customer Satisfaction

When conducting market research and writing survey questions, take care to avoid bias telegraphing the answers you hope to receive. Avoid jargon or abbreviations, or, ensure they are well defined.

Ask open-ended questions. These let respondents ruminate about what they like about your company and what might improve the relationship. Be sure, says Ulrich, that the text boxes allow space for lengthy responses. Follow these with a multipart rating question and a corresponding multipoint scale to review your business’s specific processes. Ulrich believes that respondents more easily understand descriptive words (excellent, fair, poor, etc.) than a numbered scale.

Calculate your net promoter score. Ask respondents how likely, on a scale from 0 to 10, they are to recommend your company, product, or service to others. The net promoter score is derived by subtracting the percentage of “detractors” (customers who rate the business from 0 to 6) from the percentage of “promoters” (who rate the company 9 or 10). The greater the difference, the more likely that your company can convert the enthusiasm of current customers into new customers. Sites like Net Promoter (netpromoter.com) offer more information about these scores and comparisons with leading companies. Or simply view your score as a useful general indicator of your customers’ feelings about your product or service.

Ask for suggestions. Sprague likes to conclude the customer satisfaction portion of a survey with a query like: “What could we do to make your next experience with us extraordinary?” “It stretches their mind and your mind,” he says. “It’s going to help you think of things you haven’t thought of before.”

4. Dig for Demographics

The demographic information you seek will depend on which attributes drive your business — these may include age, gender, marital status, educational attainment, household income, and leisure pursuits. Some of these are sensitive topics, and you don’t always need to broach them. For instance, if you know a customer’s Zip code, you can get a rough idea of income and education. If you know the address, you can refine that further by sorting customers into what are called census block groups, says Jeffrey DeBellis, director of marketing and research services at the University of North Carolina’s Small Business and Technology Development Center.

When your customers are businesses, you want information about their size by a number of employees and revenue. (If your customers are reluctant to share that information, formulate the responses as a series of ranges.) Also, try to get the NAICS (or North American Industry Classification System) or SIC (or Standard Industry Classification, which has been replaced by the NAICS) code. This can help you identify similar companies in the area.

5. Test the Survey First

Before you make the survey available to your customers, ask family members and friends to test it for time and clarity, and whether the questions mean what you intend them to mean and are free of bias and the like.

Using the Data

Once you tabulate the results, patterns should emerge. “If you have 20 answers, and you don’t see definite trends, then you probably don’t have enough data,” says Sprague. You could try to resurvey, using the existing results to write more probing and targeted questions, or you could convene a focus group. Focus groups are also useful for interpreting the results.

Focus, focus, focus. For focus-group testing, it is smart to engage experienced marketing consultants, who will be adept at moderating the conversation. For one thing, your subjects will probably be more reticent if you or your top sales executive are conducting the session. “With a trained focus-group facilitator, you’re going to have someone who will generally script the experience up front,” says Ulrich. Moreover, “experienced facilitators develop a certain amount of intuition when something’s up,” sensing when the dynamic has changed and able to steer the conversation in a new direction if necessary.

The “aha” moment. Ulrich recommends that once you have collected all the data, “find one or two ‘aha’ ideas and implement them immediately. Make sure they’re visible and that they impact the greatest number of people in a positive way.” This will show, she says, that you have been listening to the needs and concerns of your customers — which, any great salesperson will tell you, is half the job.

Decoding Demographics

The Web offers databases and automated services that can help make sense of the survey data you collect. Some are free, but the most useful involve fees or subscriptions. Check with your public library and local “economic gardening” organizations — such as Small Business Development Centers, chambers of commerce, and economic development groups — to see if they offer free or discounted access.